Brazil Suspends WhatsApp Digital Payments Service

Brazil, the second largest market for WhatsApp with 120 million users, has suspended the instant messaging app’s mobile payments service a week after its rollout.

In a statement, Brazil’s central bank said;

The decision was taken to preserve an adequate competitive environment in the mobile payments space and to ensure functioning of a payment system that’s interchangeable, fast, secure, transparent, open and cheap.

Read Also: WhatsApp Launches Payment Service In Brazil Two Years After Testing In India

The central bank also cited data privacy concerns.

Banks in the nation have asked Mastercard and Visa, who are among the payments partners for WhatsApp in Brazil, to suspend money transfer on WhatsApp app.

Failure to comply with the order would subject the payments companies to fines and administrative sanctions.

In its statement, Brazil’s central bank suggested that the WhatsApp’s payments service was not analyzed prior to its rollout.

Tuesday’s announcement is the latest setback for Facebook, which began testing WhatsApp Pay in India two years ago and is still yet to receive the regulatory approval to expand the payments service nationwide.

Other than India, which is WhatsApp’s largest market with 400 million users, WhatsApp has also been testing Pay in Mexico.

TechCrunch reports that a WhatsApp spokesperson reacting to the suspension said the service’s goal is to use an ‘open model’ and it is continuing to engage with “local partners and the Central Bank to make this possible”.

The spokesperson added;

In addition, we support the Central Bank’s PIX project on digital payments and together with our partners are committed to work with the Central Bank to integrate our systems when PIX becomes available.

PIX is the central bank’s own payment service set to launch in November 2020, which it has secured partnerships with nearly 1,000 industry players.

WhatsApp however rolled out its own mobile payments service in Brazil last week.

It was the first time WhatsApp had been able to conduct a nation-wide rollout of its payments service in any market, as the rollout in India is being stalled.

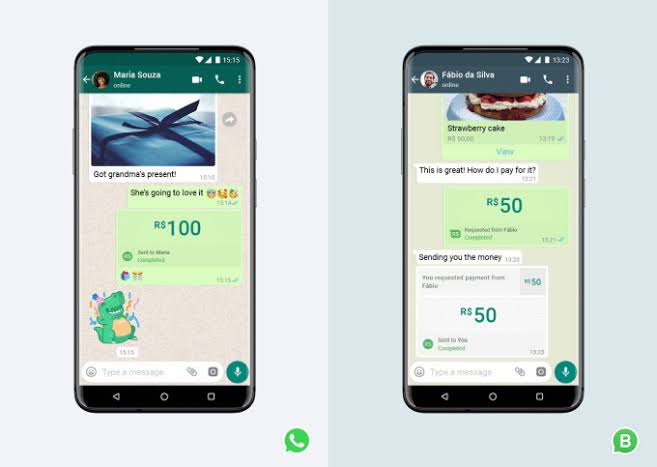

WhatsApp Pay service enables users to send money with one another and also pay small and medium-sized businesses.

The Facebook-owned service said at the time that it was not levying any fee to users for sending or receiving money but businesses are to be charged a small fee similar to a typical credit card transaction.

It is however unclear whether WhatsApp, Mastercard, and Visa have already complied with the central bank’s notice.